Luxury Market Slip and Slide (WWD)

What do the latest downward trends in the global economy mean for the luxury market?

- China’s economic decline spells trouble for luxury retailers like Hermes, Chanel and Prada

- Chinese currency devaluations this month make luxury goods more expensive for Chinese consumers and tourists spending abroad

- Will retailers diversify out of China or change their pricing structure to maintain revenues?

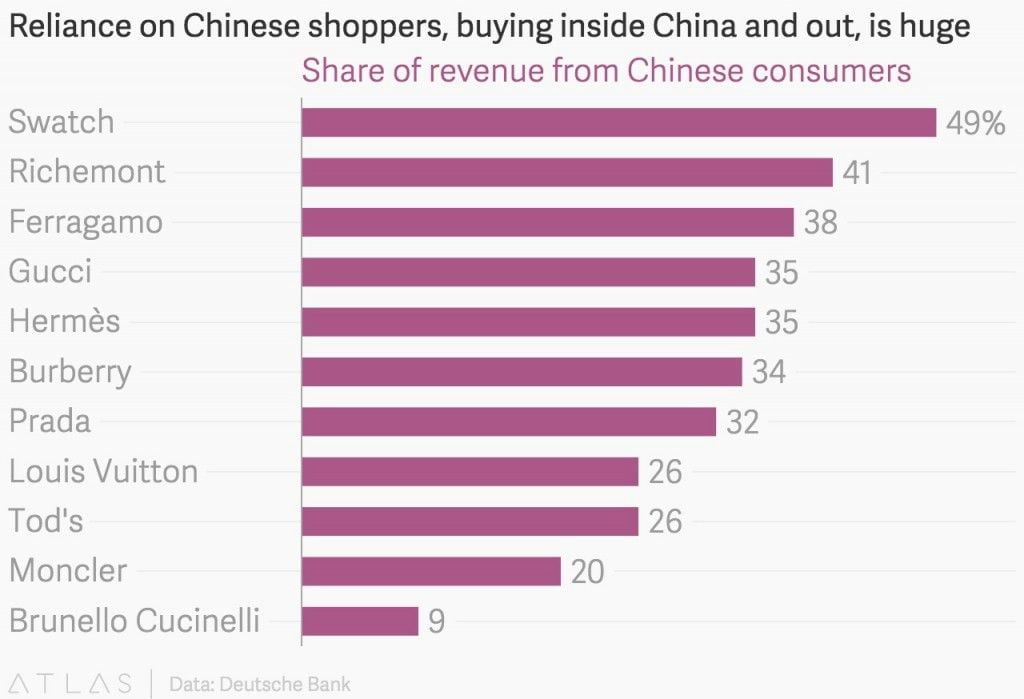

With it’s massive growth over the past few years, Asia, particularly China, has become one of the most important global markets for luxury retailers. As growth in Europe slowed down, China began to account for a greater percentage of sales and revenue for brands like Chanel, Prada, Hermes, and Salvatore Ferragamo. While this sustained and increased profit levels for these companies for years, their luck may be running out.

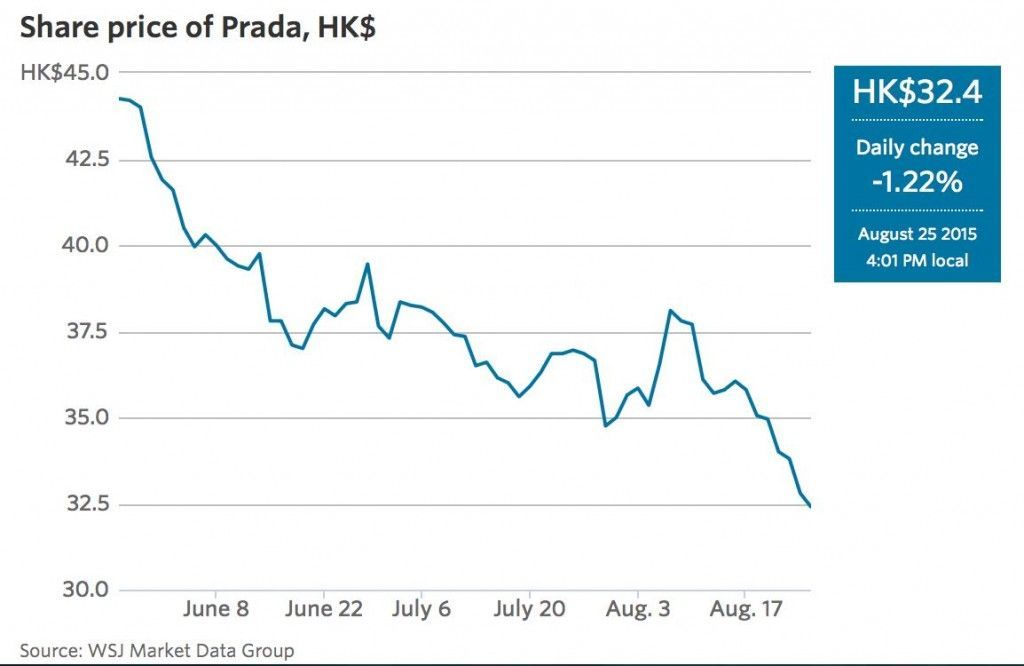

Prada shares on the decline (WSJ)

In recent months, China’s economy has experienced a huge pullback and is looking more and more incapable of achieving its 7% GDP growth target for the year. To fight back against flailing debt-driven investment on construction and infrastructure as well as decreased consumer wealth due to stock market declines, China has taken a series of dramatic economic actions with huge import for the luxury goods market. Since last November, China cut interest rates five times and this month devalued its currency three times, a total decline of 4.5% against the US dollar. While this could increase exports to the US and Europe, it could spell doom for many international luxury retailers who count on China for around 25% of their revenues.

A currency devaluation is essentially like a sale for foreign countries and a tax on international goods in the domestic Chinese market. While an American company is now able to import Chinese goods at a 4% discount, domestic Chinese consumers have to spend 4% more on purchasing international goods inside the country.

A falling Chinese currency means smaller revenues in China and most likely declining sales by Chinese tourists to Europe and the US. Luxury prices are already 30+% higher due to import duties in China – a gap only set to widen with a declining yuan.

Luxury brands are increasingly dependent on the Chinese consumer (Quartz)

Markets are taking notice. Since August 11th, the MSCI Europe Textiles Apparel & Luxury Goods Index, a good barometer for the health of the global luxury industry, has fallen 6.4%. According to researcher Markit, short interest in luxury stocks is up 20% since February, a sign that hedge funds are betting significantly against companies like Prada and Ferragamo. Companies like Tag Heuer have already pulled out of China completely and it appears the bad news will only continue for the rest of the market. Only time will tell…

Moral of the story? Don’t put all your eggs in one basket.

LovePurseBop

XO

Updated: May 28th, 2017

Comments

1 Responses to “China Woes Weigh Heavy on Luxury Market”

Yesss, NEVER put all your eggs in one basket! Very wise words ??! And very good post!!! PB economy highlights rocks ??❤️?