Image courtesy @h.joie_

by Maura Carlin, Editor

Well these are words I never thought I’d say or write . . . looking fondly on the days of the pandemic, at least when it comes to Hermès (or luxury) handbag pricing. Since as far back as I’ve been tracking (also known as purchasing lol) Hermès bags, the Maison’s US pricing strategies were clear and easy to understand. Annual price increases occurred in the first quarter of the year, typically between 3 and 5%. Customers could chalk it up to inflation, real or imaginary, but you knew what to expect, and prices seemed relatively stable.

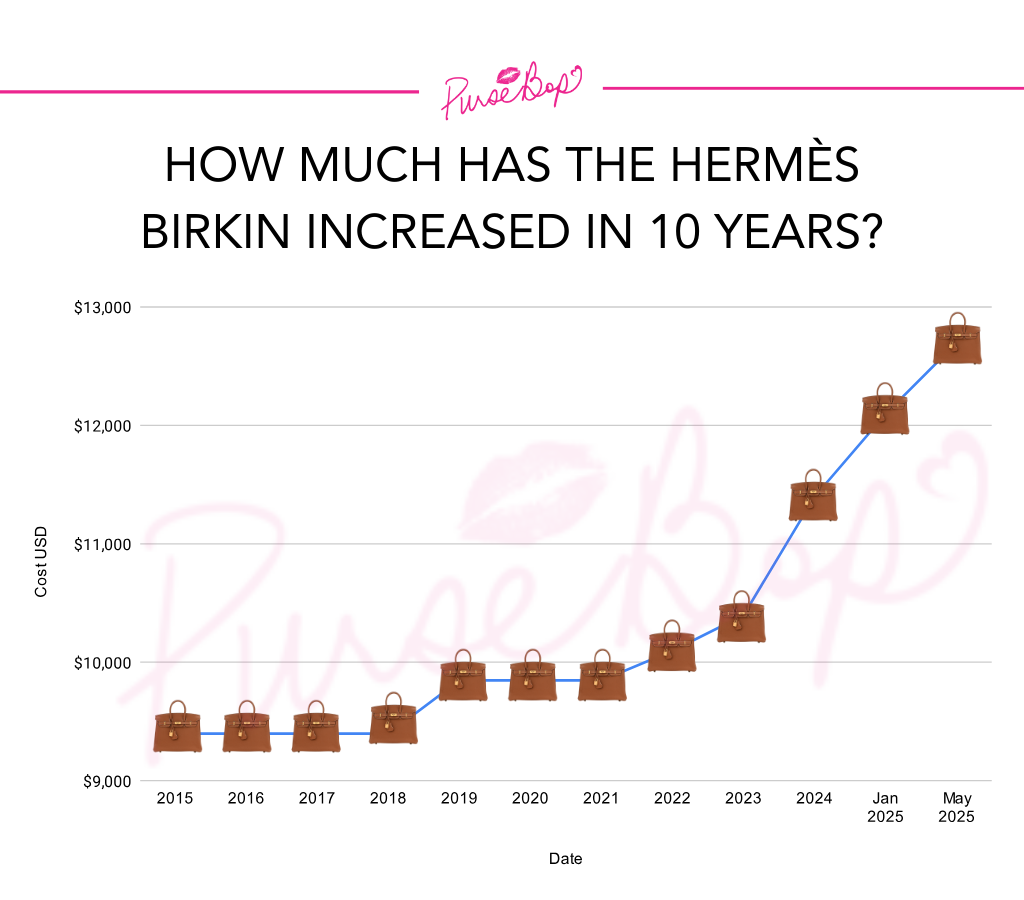

The PurseBop team diligently charts the prices of many popular Hermès bags and reports on the price hikes as they are imposed. Ten years of this data tells an interesting story. For this, the focus is the Birkin 25 in Togo leather.

Between 2015 and 2025, the price of the B25 increased 35% from $9,400 to $12,100. This is slightly above the estimated 28-33% increase in the US cost of living over that period. Look deeper, though, and it gets interesting: most of that increase occurred after 2021. From 2015 through 2021, the B25 price rose only 4.78%.

How could that be, you’re wondering? Well, Hermès prices for the bag remained flat during 2015-2018 and the pandemic years of 2019 through 2021. Between 2015 and 2018, the retail cost of the B25 in Togo leather stood at $9,400. That’s right, for four consecutive years, the price did not change.

In 2019, Hermès imposed a 4.8% price hike, lifting the bag’s tag to $9,850. It stayed at $9,850 through the height of the pandemic. In 2022 and again in 2023, the price rose by just under 3%, consistent with the historical increases. However, perhaps shocking to some, the cost of the B25 did extend to five figures, just over $10,000.

From when @pursebop got her first Birkin 25 in 2015.

And then, something changed as the pandemic hit the rearview mirror. The US price spikes have blown through any previously self-imposed Hermès pricing restraints. In 2024, a $1000 increase, or nearly 10%, brought the bag’s cost to $11,100. Barely one year later, in January 2025 (earlier in the year than usual), the price jumped another $700, or 6%; not awful, but greater than typical. Four months later came another increase, this time 5%, blamed on the new and additional 10% US tariffs on EU products. A potential additional 10% tariff remains on pause for now.

Image courtesy @pursebop

If it seems as though Hermès is playing pricing catch-up, that might be right. After all, during that same 10 years, prices for the Chanel 11.12 Classic Flap more than doubled. By the Coco standard, Hermès prices are still too low.

On the other hand, where would B25 pricing be if Hermès had imposed 5% increases in each of 2023, 2024, and 2025? We did the math. The answer is: just under $12K at $11,991, or $709 less than now. And when you are buying a $12,000 handbag with limited availability, will an extra $709 cost affect your decision? Hermès likely thinks not. In which case, these accelerating hikes as a pricing strategy begin to make sense.

Image courtesy: Red

As clients old and new clamor for Hermès bags, both the quota Birkins and Kellys and many other coveted non-quota styles, the true bar to access is availability, not price. Most people still cannot walk into a boutique, ask for a Birkin, and walk out that day with what they want. And Hermès seems to like it that way. Even as Hermès says anyone can get a bag, it acknowledges that purchasing is not immediate. Artistic Director (and brand heir) Alexis Dumas told CBS News,

“It’s a long process. You go to a store, you get an appointment, you meet a salesperson, you talk about what you want. It’s not available. You’ll have to wait. They’ll come back to you. It takes a long time. Eventually, it’s going to happen.”

Left blank are details about how this will happen, euphemistically discussed as developing and maintaining a relationship, or, as many say, building a purchasing history. Put another way, the longer you are required to wait, the more you are likely to spend. It’s a game of heads, Hermès wins; tails, Hermès wins!

Now, in the United States, prices for Hermès bags are higher than in other parts of the world, particularly as compared to EU pricing. The recent imposition of an additional 10% US tariff is the justification for the second US price increase in 2025. Hermès’ CEO, Axel Dumas, forewarned investors and clients in February and April 2025 that any new US tariff costs would be passed on to US customers. Thus far, that seems to be the case, although it is impossible to know precisely the additional expense incurred in bringing items stateside.

Read:

Hermès Q1 Growth: Tariffs and a Price Increase

Handbag Math: Luxury Shopping Tariffs Explained

Hermès Revenues Up 15% in 2024 With Leather Goods Division Continuing to Surge

Image courtesy: Red

In the days leading up to the promised hikes, American clients were allegedly and frantically texting Hermès SAs begging for products before prices rose. Some likely were successful, but for the most part, supply (or lack thereof) dictated that few eked out a B25 in time. Yet, for all the hubbub, angst, and urgency on social media, there’s little chatter about fashionistas giving up on dreams of a Hermès handbag due to the price increase.

In other words, Americans seem willing to pay that extra $709 for the B25. At the same time, many have made plans to shop in Europe, hoping to nab a bag at EU pricing, a task no easier abroad than at home. Just ask anyone who has tried their luck lately at obtaining a leather appointment let alone a bag in one of three Paris Hermès boutiques.

Of course, Hermès’ calculation could be wrong. Consultancy Bain & Co has revised downwards its vision of the luxury industry this year. Rather than the flat to 4% expected growth in 2025, Bain sees a decline of 2-4% in sales. Per Reuters, Bain said the luxury market faced “more complex turbulence across multiple axes.” Its survey of American luxury consumers found that 75% of shoppers were not concerned about tariffs, but about half had pulled back on luxury spending in the last year due to increased prices.

Read more here

With Bain’s analysis in mind, demand at US Hermès boutiques could drop precipitously. There are reports of some stores having less foot traffic in recent days, but it is still too early to tell. Further, given the uncertainty about tariffs, some would-be shoppers have adopted a wait-and-see approach, hoping the US rescinds the extra 10% tariff on EU goods.

And then there is the big question – what happens if that US tariff assessment disappears? Will Hermès reduce US prices? Or, will this be an opportunity to further boost the bottom line? Hermès’ response will be telling.

Updated: July 15th, 2025

Comments