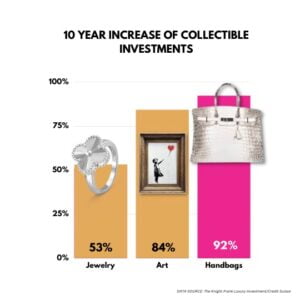

Despite the trouble we’ve seen in the market this year, handbag sales steadily continue to increase…at least for some luxury brands. (Read: Handbags Keep Luxury Afloat) Lots of consumers look to invest in handbags because of their value as both functional accessories, and more importantly, status symbols. Exclusivity and price are both factors that play into a bag’s role as a status symbol. In recent years, some brands like Michael Kors, Coach, Ralph Lauren, and Kate Spade have diluted this sense of exclusivity by offering their products in too many department stores and outlets at discounted rates. The glitz and glam of these brands is dwindling…so are sales. With this in mind, some brands are starting to make drastic changes to stay afloat with their luxury peers.

Michael Kors handbag section in Macy’s in Herald Square seen in May. Photo Courtesy: Mallory Schlossberg/Business Insider.

The Problem of Overexposure

Many mid-tier retailers like Michael Kors and Ralph Lauren are heavily dependent on department stores for sales. But an overall decrease in mall traffic and a slow down in tourism is making it hard for department stores to move inventory, period. To entice shoppers, retailers discount the products, which unintentionally hurts the brands exclusivity. In an interview with Business insider, consulting analyst Gabriella Santaniello, describes this problem in detail:

“It’s a promotional environment, and I think that’s the problem. The problem with these three brands in particular is there’s a difference between the department store distribution and the retail distribution, and unfortunately there’s some overlap in the handbags and the assortment between retail and wholesale, and with that, when you’re in wholesale there’s a lack of control in their brand, and ultimately the department store is going to do what they have to do to drive sales — and that includes promotional activity.”

Same-Store Sales Decrease for Michael Kors and Ralph Lauren. Photo Courtesy: Wall Street Journal.

Essentially, consumers are overexposed. They’re not itching to buy new bags from these brands because they know there’s a good chance they can get them cheaper somewhere else. Last year, even Kate Spade, which is a little less exposed and more exclusive than Michael Kors and Coach, experienced a dip in sales of their novelty handbags.

Kate Spade Summer Themed Novelty Tote ~ @katespadeny

Rebuilding Exclusivity

Morgan Stanley reported that both Macy’s and Nordstrom experienced a “deceleration in the handbag category” last year. The decrease in handbag sales is representative of a bigger problem we’ve touched on many times here. Shoppers want to spend their money on experiences, not just material items.

As reported by CNBC, CEO of Michael Kors, John Idol, firmly asserted that the brand “will no longer participate in department stores’ broad-based friends and family sales, or accept coupons for its products there starting in February.” The company will also “move forward with its strategy to cut back on the amount of merchandise it ships to retailers, as it looks to rebuild the pricing power it has lost with shoppers.”

Ralph Lauren is taking a similar approach by closing retail shops, streamlining products, and speeding up sourcing. Ralph Lauren CEO, Stefan Larsson, also shared with WSJ that the company is making an effort to improve the quality and design of products in order to sell more items are full price.

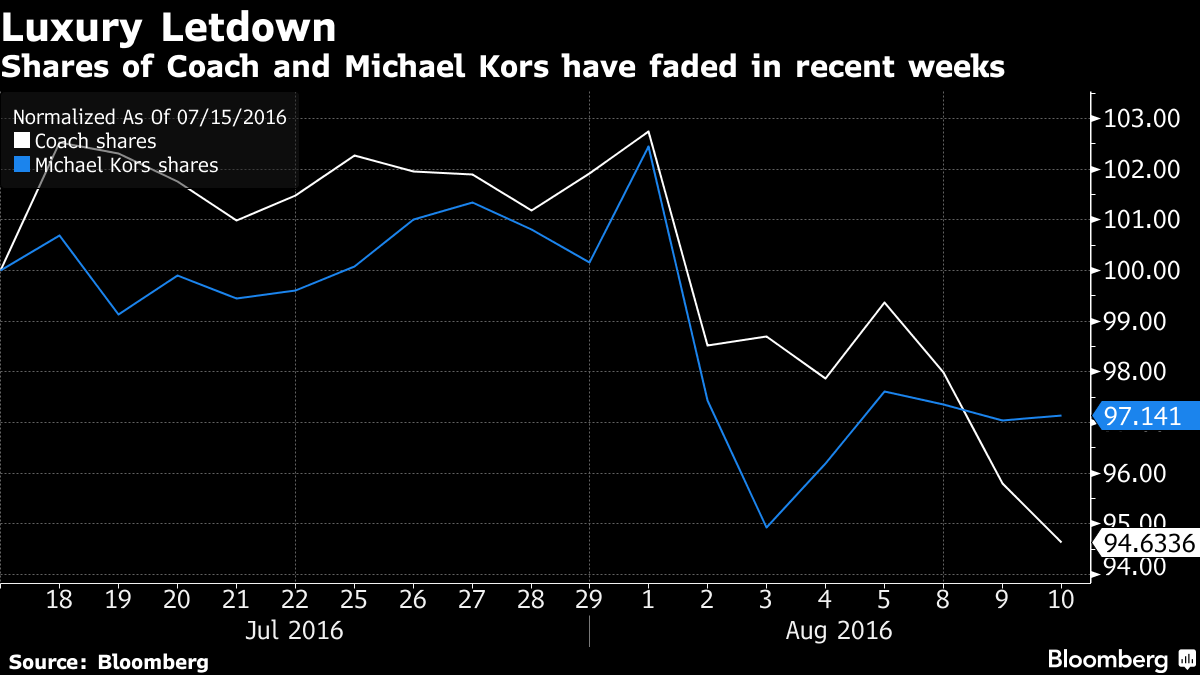

Shares of Coach and Michael Kors have dropped recently. Brands are looking for a solution to increase profit. Picture Courtesy: Bloomberg

Michael Kors Fall Marketing: Striving for a more luxurious appeal. ~ @michaelkors

@ralphlauren

On a brighter note, according to Quartz, Coach is taking somewhat of a turnaround and faring a little better than their competitors. For the first time since 2013, Coach’s same-store sales have increased 2% for the fourth quarter, which marks a 26% upswing since the start of 2015. Coach recently hired Stuart Vevers as their new creative director and launched a runway collection called Coach 1941. Coach 1941 has been marketed in fashion editorials and is sold in Coach’s retailer stores and other trendy, high-end specialty shops. Coach hopes that the momentum of this collection will stop future discounts and appeal to a younger generation of shoppers.

Coach Same-Store Sales Increase. Picture Courtesy: Quartz

Fall Bag from the Coach 1941 Collection

Over the next few months, these retailers may stand to see an increase in sales if they can revitalize their collections and create more hype around their products. However, the numbers are still uncertain. Do you think the association and reputation of brands like Michael Kors, Coach, and Ralph Lauren are too heavily rooted in “everyday luxury” to change to a more elevated status? (Read: From Coach to Hermes – The Luxury Hierarchy to better understand the different tiers of designer brands)

Read related articles below:

Handbags Keep Luxury Afloat

Luxury 2016: The Year of Struggle

Luxury Market Expected to Bottom Out This Year

China Woes Weigh Heavy on Luxury Market

Luxury Market Expects Weakest Year Since Lehman Crash

The Luxury Market after the Paris Attacks?

Updated: May 27th, 2017

Comments