4 stalwarts of the luxury handbag world—Hermès, Louis Vuitton, Gucci, and Burberry—recently reduced their prices in China across the board. These European brand markdowns followed the Chinese government’s decision in July to reduce import duties and VAT on consumer goods.

BoF recently shared important analysis of these markdowns and the Chinese luxury market. We’re here to help unpack that as well as look at the impact of the Chinese market on the global luxury industry more broadly. In short, the implications are significant, extending far beyond price reductions for Chinese buyers.

Photo courtesy: REUTERS/Philippe Wojazer

The Tariff Rates and Markdowns

In early July, the average import tariff rates for fashion goods and accessories in China went from 15.9% to 7.1%, as BoF reported. This is part of a larger move to a consumer-driven model for the country’s future economic growth, especially as industrial output slows. To the excitement of luxury buyers across the country, brands have reduced prices by between 3 and 5%.

Louis Vuitton was the first to drop at the beginning of the month. (For example, the Neverfull MM tote bag was reduced to 9,900 yuan ($1,462) from 10,400 yuan ($1,536). Gucci followed, at about 5%, then H and Burberry at about 4%. It is likely that other designer brands will continue the trend. Chanel, however, will not, as it already decreased prices in China in 2015 in accordance with its price harmonization strategy and does not intend to reduce them any further.

Photo courtesy: TungCheung / Shutterstock.com

Broader Luxury Market Trends Across the Globe

More importantly for the brands than creating cheaper options for consumers, the price changes represent steps toward global pricing harmonization. The prices of luxury goods purchased in Italy and France last year were 22% less than the global average, while those in China were 21% more. While such discrepancies have affected where Chinese consumers decide to make their luxury purchases, what affects the brands more is the lack of synchronization around the world, which makes it difficult to manage global brands effectively. This, in turn, results in a general reduction in sales.

“Even before any of the tax cuts came into play, brands were already thinking about how to achieve uniformity, so that Chinese consumers wouldn’t go to their stores and see them as showrooms for what they’ll eventually purchase overseas,” China Market Research Consulting’s senior researcher Benjamin Cavender told BoF.

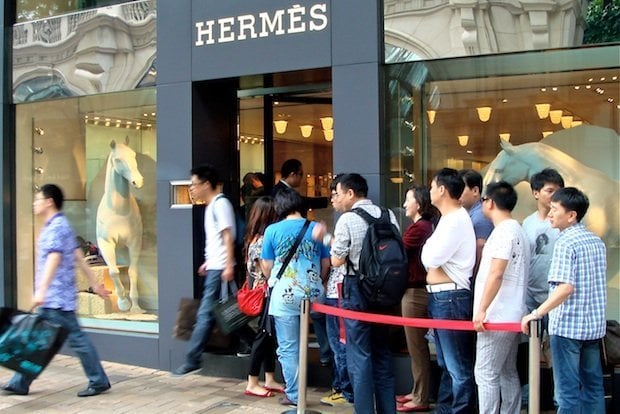

Hermès Hong Kong. Photo courtesy: Bon Brand

The Importance of China in All of This

In short, luxury brands rely heavily on China. Chinese buyers, according to BoF, are estimated to comprise 1/3 of luxury sales across the globe. Last year, the luxury goods market in mainland China reached 142 billion yuan (which was a 20% rise from 2016, the previous year), as Asia Times reported. Due in part to growth in China, luxury brands are similarly experiencing a rise in revenues this year. China has been especially important for the French market, as the Financial Times recently noted, in particular LVMH, Kering (the owner of Gucci, Saint Laurent, and others), and Hermès.

And while the price reductions, at only 3 to 5%, may seem like a small change for Chinese buyers, they has wider implications for purchasing. Right now, China has a thriving “daigou market,” whereby personal shoppers overseas buy luxury goods for those living in mainland China. If prices continue to harmonize, the daigou market will presumably become less widespread, rendering the chain of consumption more direct.

Currently, about 3/4 of Chinese luxury spending takes place outside of China. The move toward harmonization only makes sense, given China’s importance in the world luxury market. “It’s hard to predict when exactly total price normalisation will occur,” Cavender told BoF, “but I wouldn’t be surprised if we see some brands setting China to the same price point as Europe within the next 5 years.”

@pretty_purses

What's Next? U.S.-China Trade Tensions

While we can’t accurately predict the future, there is considerable worry that China’s potential to buoy the luxury goods market is not going to last. With trade tensions escalating between the U.S. and China, experts worry that the luxury market in China will be negatively affected. While “the luxury industry is not in the frontline on this”, Jean-Jacques Guiony, LVMH’s chief financial officer said, “such a risk could certainly bear some negative consequences for us”.

For now, we’ll just have to wait and see. Fingers crossed.

@happybaggage

Read related articles:

Big Bucks in Bags

Hermès Birkin Prices 2018: USA vs. Europe

Chanel Pulls Back Its Financial Robe

Don’t Cry for Hermès – Record Profitability in 2017

Love, PurseBop

XO

Updated: August 16th, 2018

Comments