What will you do with the money if you win the Powerball tonight? Perhaps you want to know what to do with that end-of-year bonus and tax refund. Purse aficionados considering stashing assets in gold or the S&P 500 might want to think again. It turns out the “safest and least volatile” investment of those three may be in the bag…the Hermes Birkin bag.

Diamond Exotic Birkin, Hermes Paris

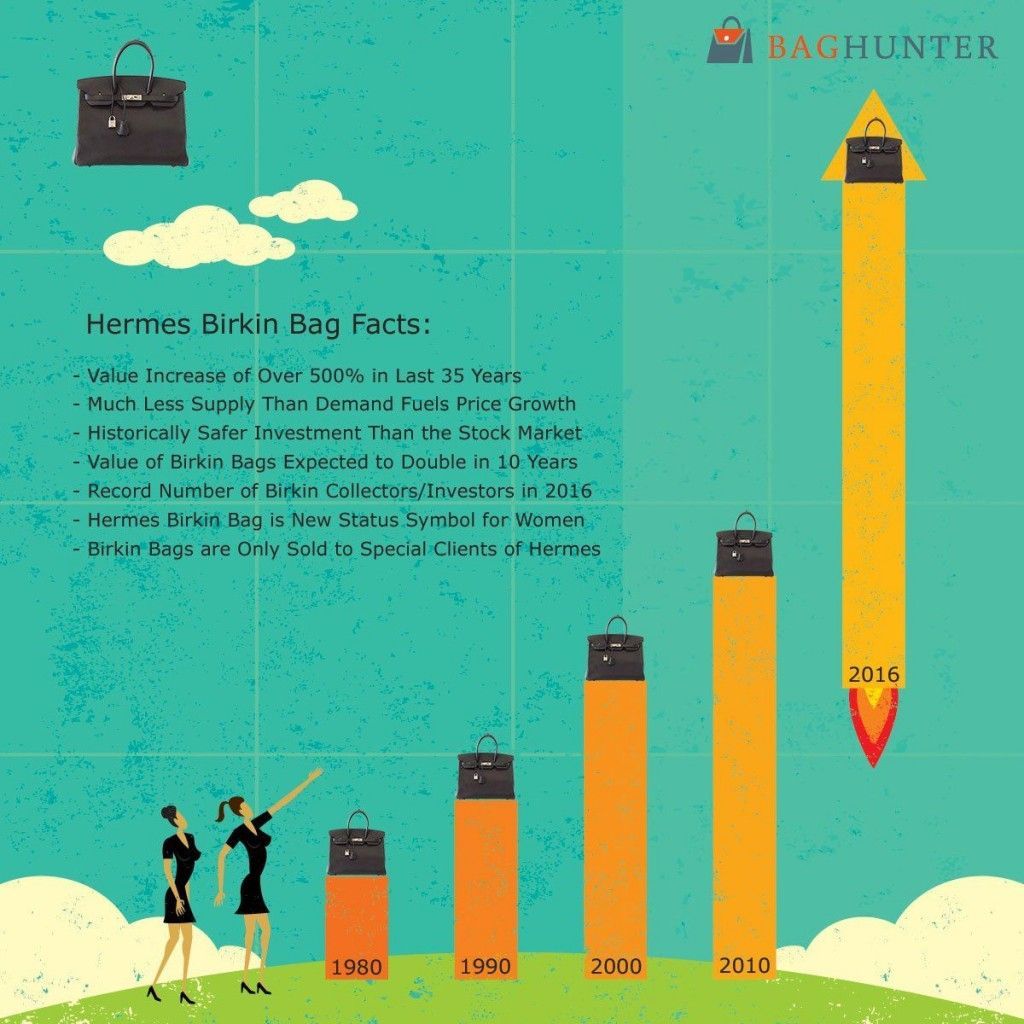

As reported in racked.com, the Baghunter compared investment returns on gold, the S&P 500, and the Birkin over the last 35 years, and the Birkin was the clear winner. In that time, the Birkin increased in value more than 500% and has never decreased even in times of recession and economic difficulty. Baghunter says the Birkin averaged annual value increases of 14.2%, significantly higher than either gold or S&P 500.

Baghunter founder Evelyn Fox told luxurydaily.com “As a whole, the study findings show how stable the ultra-luxury industry has been over the past 35 years when compared to more traditional investment opportunities.” According to Fox, “There is a difference between luxury and ultra-luxury. While the luxury market suffers during worse economic times the ultra-luxury market is impervious to economic factors that can affect other industries such as high-street retail and stock markets.”

Fox expects this trend to continue in 2016, pointing to the Birkin’s high retail prices and limited availability along with a strong secondary market from resellers.

@img178

Image courtesy BagHunter.com

Do you consider your Birkins (or other bags) investments?

Love PurseBop

XO

Explore similar posts on PurseBop:

Should a Bag be an “Investment”?

Most Expensive Birkin Sold at Christie’s

The Hermes Birkin – The Ultimate Holy Grail Bag

Updated: May 28th, 2017

Comments

1 Responses to “Gold, S&P 500, or Hermes Birkin?”

I think CC is an investment too, the prices only go up ?!!! So yeap, I do believe Birkins are investments! ?❤️?