Looking for a deep dive on what is selling in the secondary market? Well look no further. PurseBop commissioned a report from luxury resale experts at LePrix about which brands and items sell best and which have seen a decline in popularity. And part of that analysis includes how trends and attitudes of Gen Z are affecting the entire industry.

So whether you are considering rehoming your own bags, thinking of purchasing a used handbag, or factoring in which bags hold value best before buying a new one, the information you need is here.

One thing is clear. Whether luxury brands want it or not, the high end designer resale industry is here to stay. Information is power and this report will aid in your handbag acquisition decisions.

Thanks to Emily Erkel, LePrix’s Co-Founder and CMO for her excellent insights.

LePrix’s 2023 Resale Report

What an exciting time to be in the luxury pre-owned industry!

The resale industry continues to grow rapidly across the world, estimated to be $51B by 2025. More and more retailers are embracing resale as an important vertical in their business models. Consumers, particularly Gen Z, are driving the growth of the resale industry and looking for value, sustainability, and uniqueness as key drivers to buy pre-owned.

Image courtesy: @leprix

As the largest B2B platform reinventing how businesses source authenticated, pre-owned luxury, LePrix is the backbone and the engine of the luxury circular economy. LePrix sits at the intersection of what retailers are sourcing to meet current consumer demand and what they are predicting will be bestsellers in the future.

Image courtesy: @leprix

Image courtesy: @leprix

LePrix’s data analytics team performed a deep dive on what retailers are sourcing to understand industry trends and seismic shifts in what retailers are now sourcing in 2023 to meet consumer demand as well as what retailers will be sourcing into 2024.

Discover the most comprehensive analysis of the luxury resale B2B industry.

Consumers are embracing pre-owned luxury even more during uncertain times. However, what consumers want has shifted over the last few years

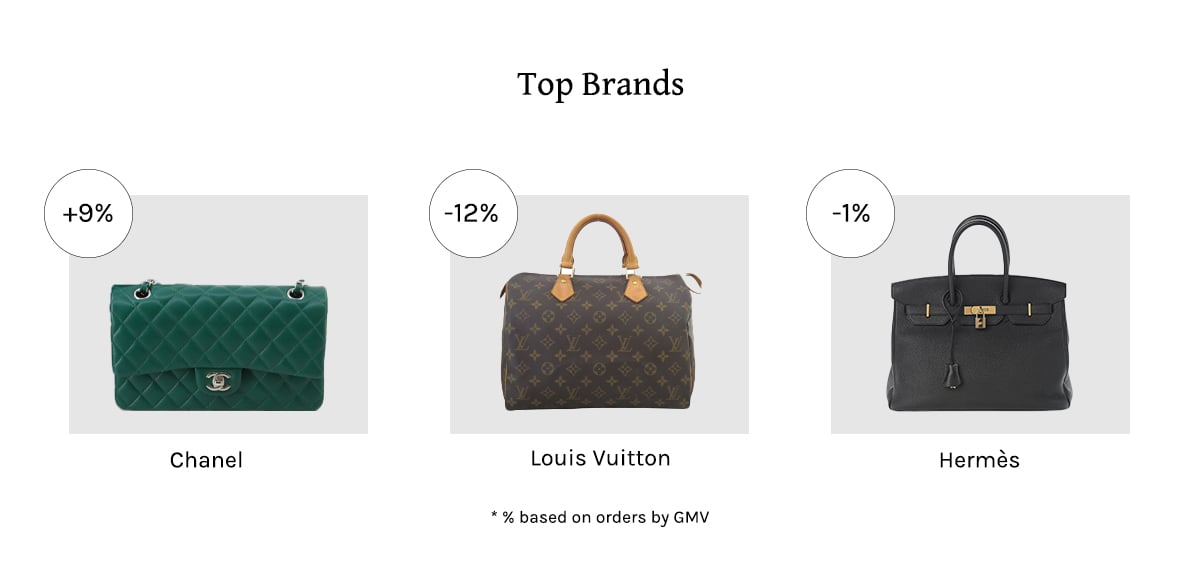

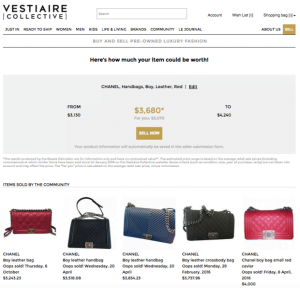

The Rise of Chanel, the Fall of Gucci

Over the last few years, the top brands sourced by businesses on LePrix were always the same – Louis Vuitton, Gucci, and Chanel. However, since 2021, Gucci has fallen out of the top 3 ranks, in terms of % share of GMV. However, they were not the only brand to lose share – Louis Vuitton dropped 12%. Meanwhile, Chanel climbed +9% and Hermès stepped into Gucci’s place and earned the spot of 3rd most popular brand on LePrix, seeing a slight decline in share 2023 vs 2022.

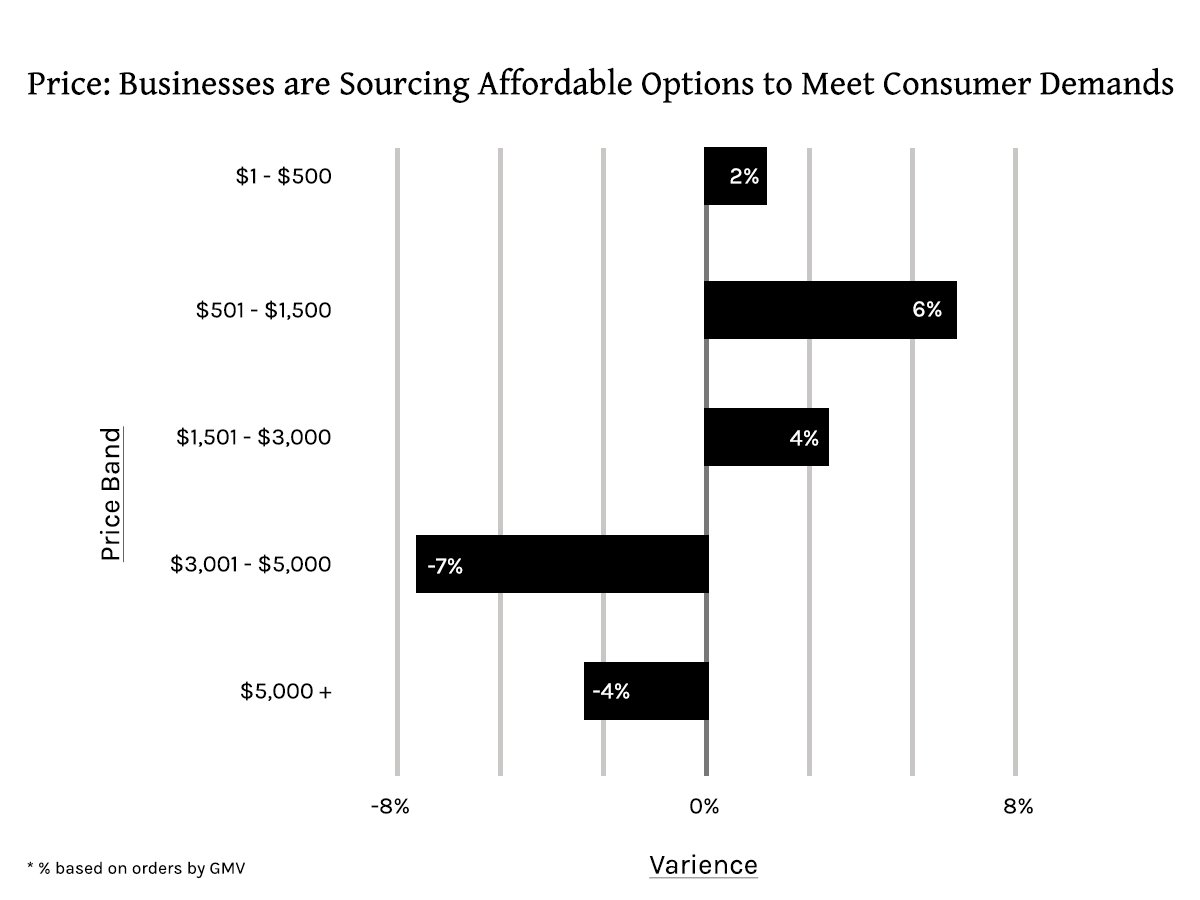

Lipstick Effect in Luxury Resale

While luxury resale continues to grow leaps and bounds, what consumers purchase is shifting too. The lipstick effect can be seen in the resale industry as well; when there is economic uncertainty, consumers shift spend towards less costly luxury goods. In lieu of buying the higher ticket handbags, for example, consumers want luxury for less. E.g. Instead of buying that $5,000 pre-owned Chanel handbag, consumers will shift that spend to a $2,500 Wallet on Chain.

Retailers follow suit and have shifted spend to lower-priced pre-owned luxury goods. However, as with the general luxury industry, there will always be demand for the high ticket items. From rare alligator Hermès Mini Kelly bags to a very vintage and special Chanel Heart Vanity bag, there will always be demand for the ultra-wealthy consumer.

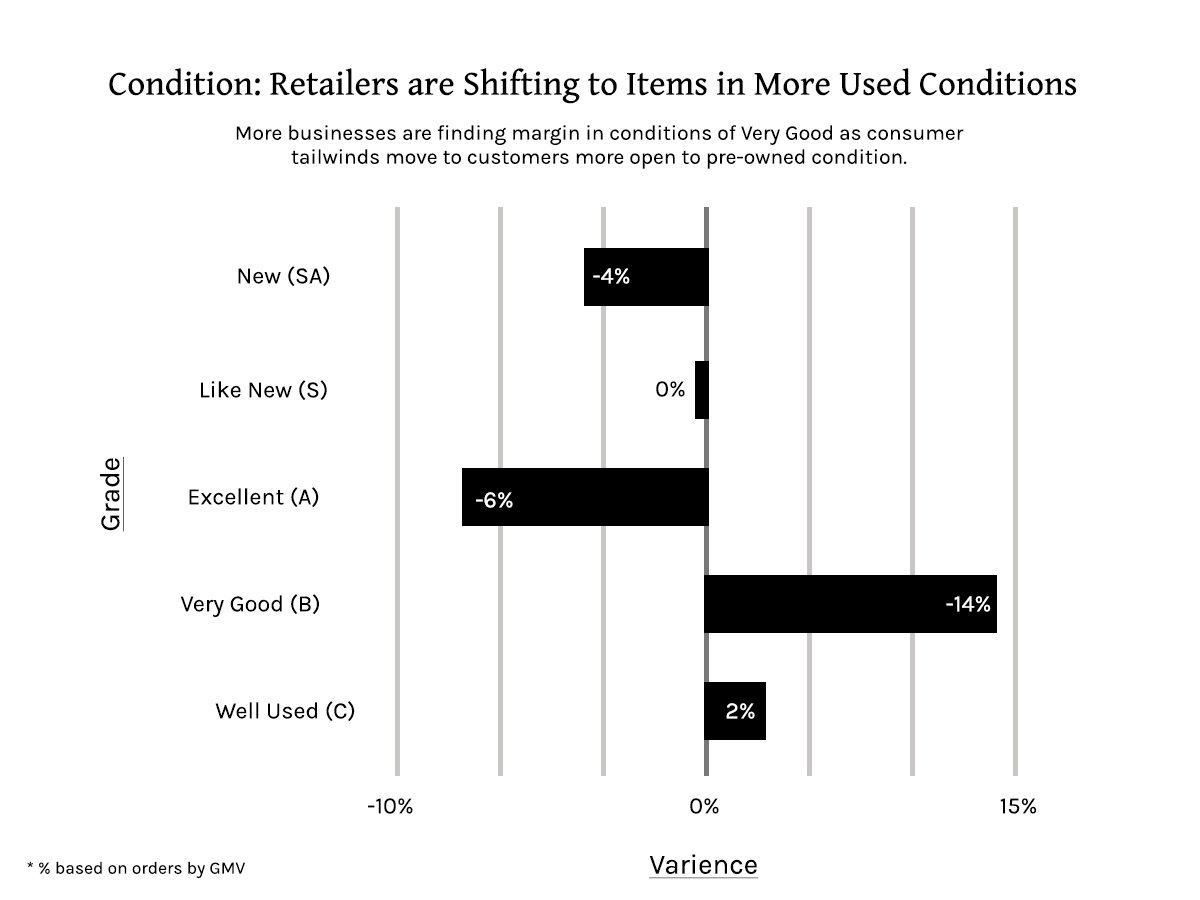

Used is the New New

As the popularity of buying pre-owned and vintage grows, consumers are now shifting purchasing spend to more used condition versus even a few years ago. This is most likely due to a few factors. First, oftentimes condition correlates to pricing so as more consumers think budget, many are adopting more used condition luxury items. The more well-worn an item is typically the lower the price is for that style. Second, the adoption of pre-owned has grown rapidly in the last few years, and long gone is the stigma surrounding used goods.

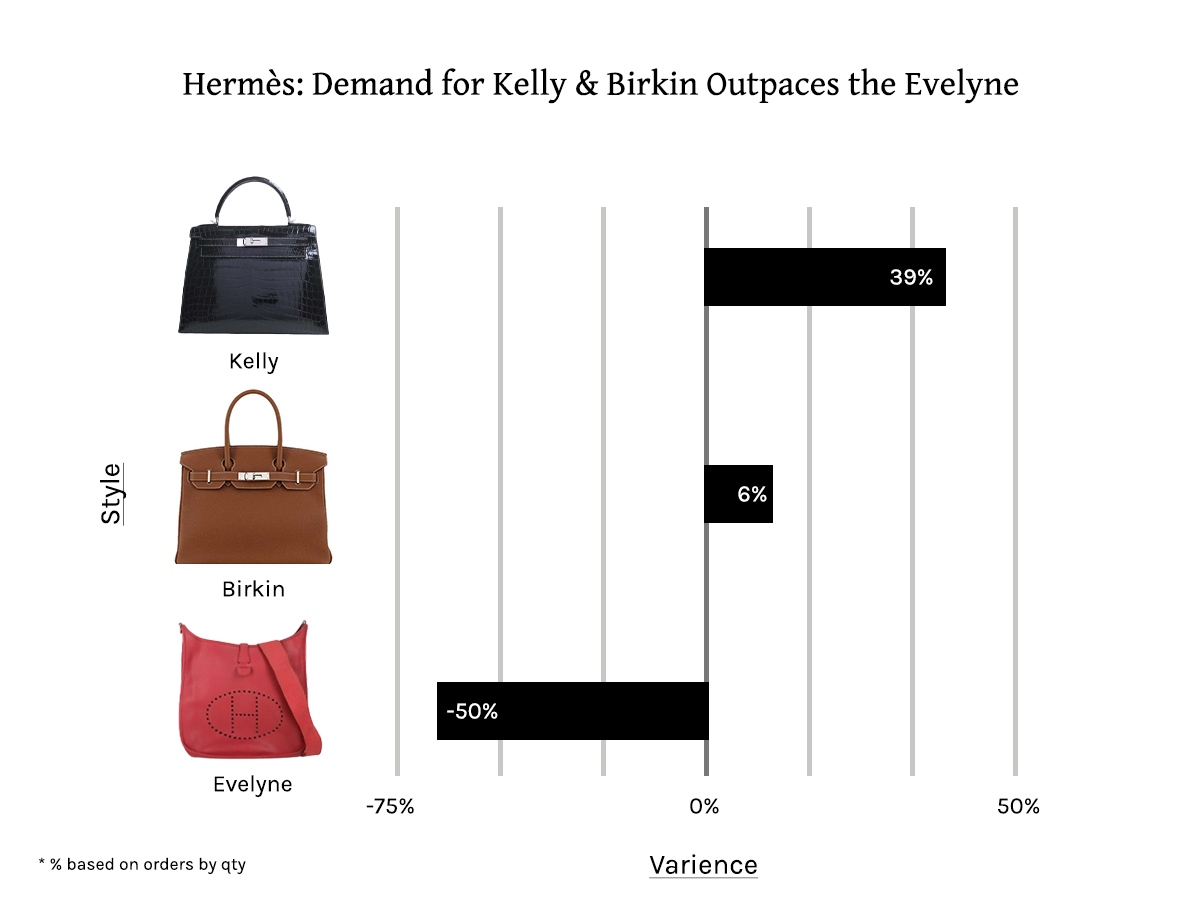

The Rise of the Hermès Investment Bags

Across the resale industry, consumers are looking for investment bags that retain their value. This can also be seen in the ultimate luxury brand in pre-owned, Hermès. Both the Birkin and the Kelly continue to see increased demand. However, bags such as the Evelyne have fallen in popularity. Within these styles, our team at LePrix has seen an increase in the most coveted colors from Rose Sakura to neutral classic colors such as Gold and Noir.

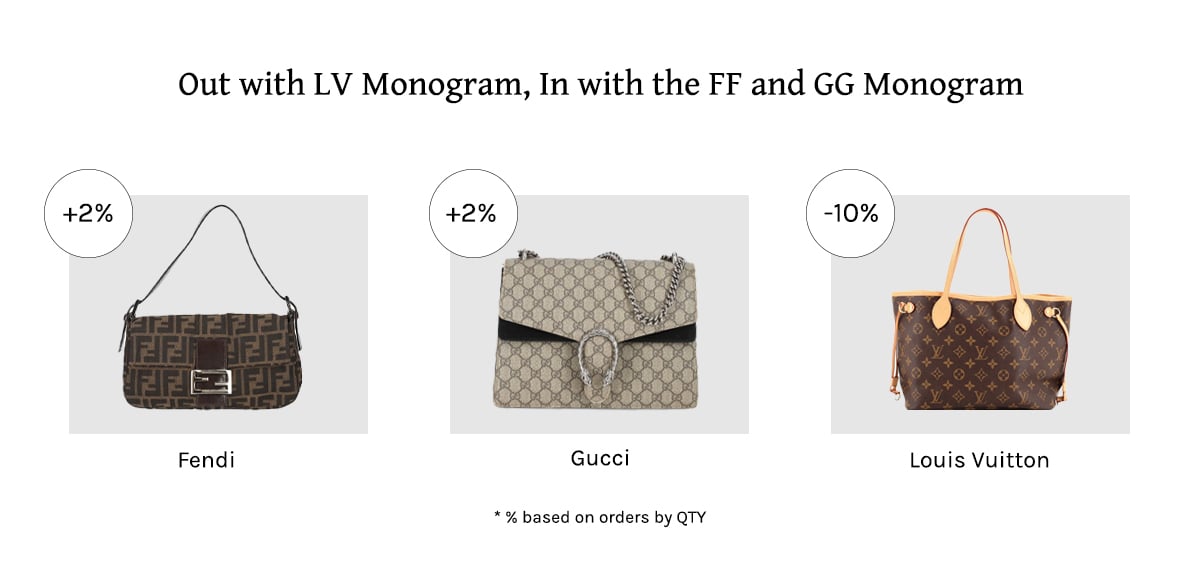

Monogram Mania

While monogram continues to be a strong consumer preference, what monogram from which brand has shifted in popularity? The rise of the Fendi baguette in the last few years, especially since its 25th anniversary last Fall, has increased demand for the Fendi Zucca monogram print. While Gucci as a brand overall has lost market share, the classic Gucci monogram continues to be high in demand.

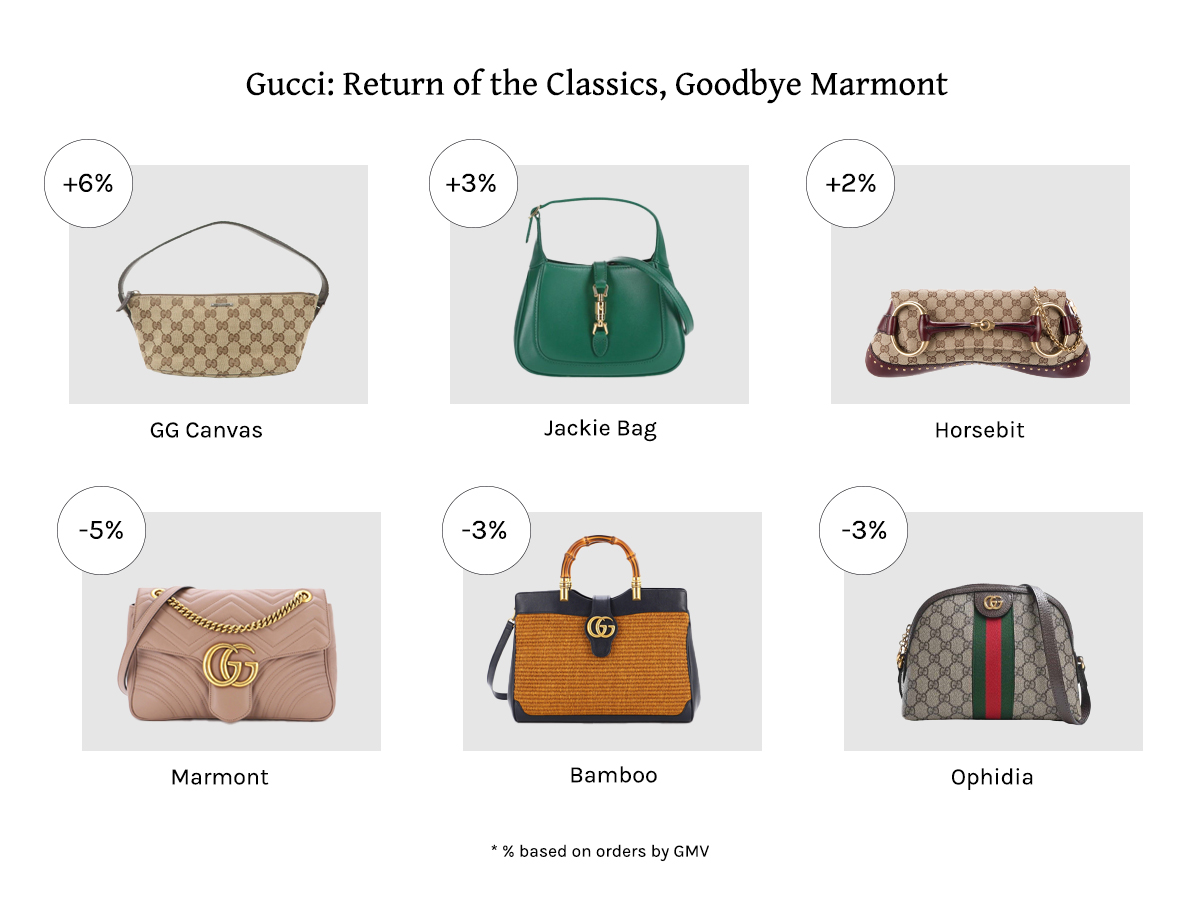

It’s Not All Gucci…

At the brand level, Gucci continues to falter as it finds its footing with the new creative director. Once trendy bags LePrix could not keep in stock have fallen, due to less popularity from the consumer side, e.g. the once coveted Marmont has decreased 5% YoY in terms of share of GMV whilst retailers return to classic monogram or horse-bit, which both grew 6% and 2% respectively.

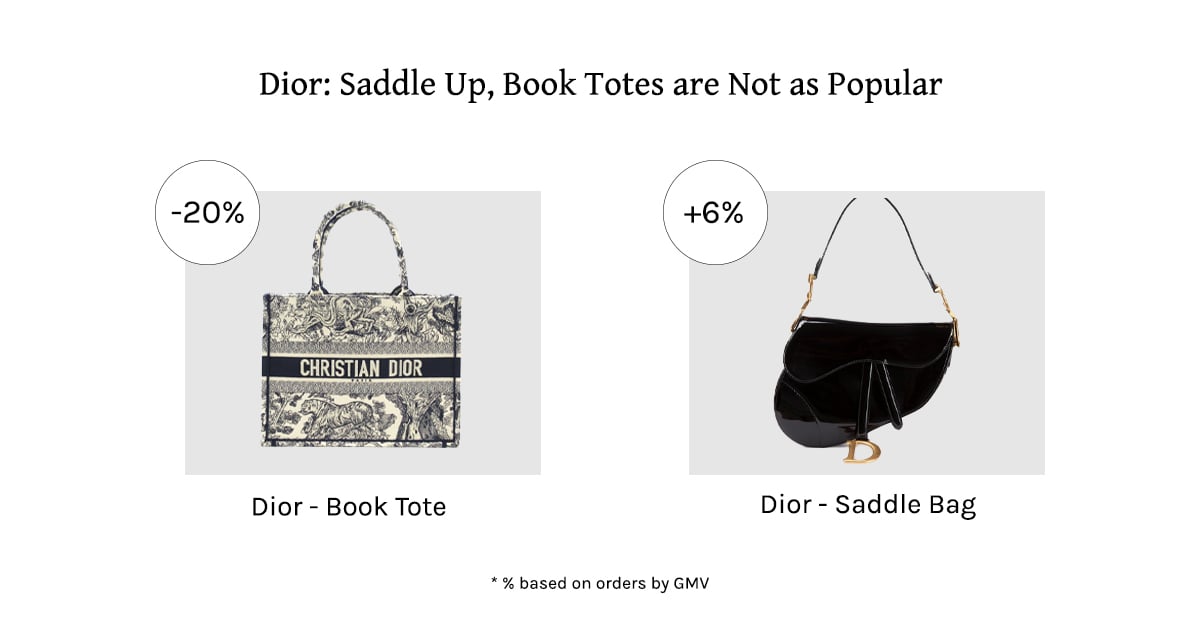

Saddle Up, Saddle Bags Are Back

While the Dior brand continues to hold steady in popularity, the styles of Dior have shifted in the last year. A couple of years ago, the Book Tote was the top style of Dior but has since declined in popularity. Meanwhile, with the 2000s making a comeback, the saddle bag increased in popularity.

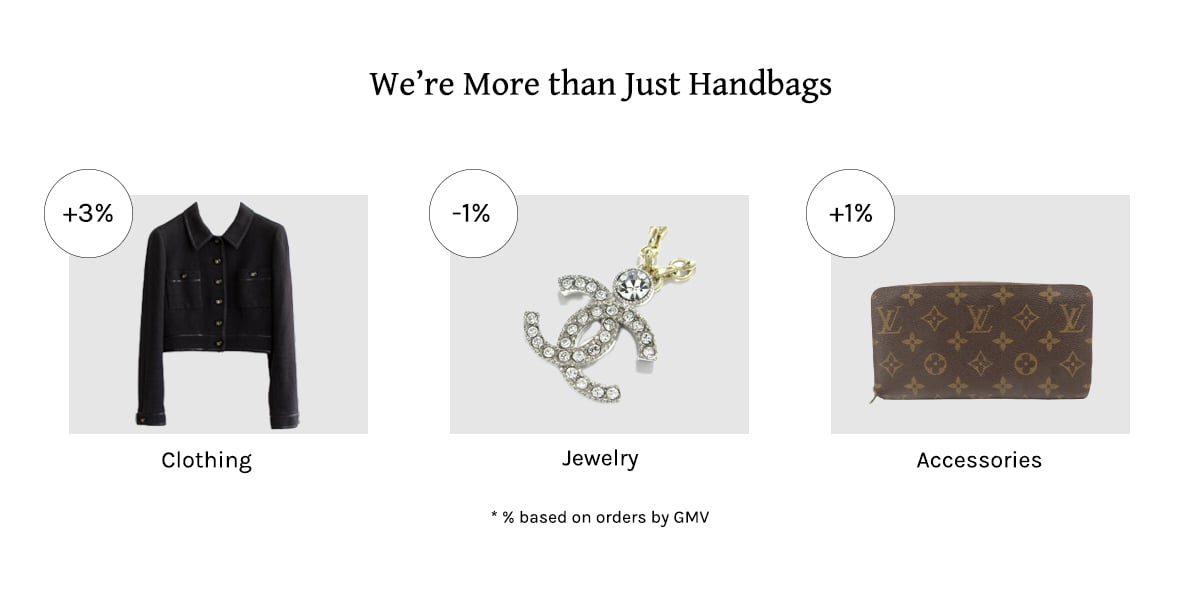

Unique and Value are Drivers in Consumer Demand

Clothing and accessories, especially small leather goods are seeing an increase in popularity. For clothing, consumers are buying pre-owned or vintage clothing more than ever now as they are looking for unique styles beyond the mass fast fashion. In addition, given the current macro environment, many consumers are more budget-conscious and shifting spend to lower price points such as small leather goods.

Saving the World, One Pre-Owned Bag at a Time

Our research shows that every time you buy pre-owned luxury, you decrease your carbon footprint and increase the lifespan of that item. Now that’s some sexy math.

Americans spend more than $11 billion on handbags a year, which roughly equates to 35 million new bags a year. If we purchased a pre-owned bag instead of a brand new bag every year, we could save over 620M lbs of CO2. That’s the equivalent of taking 62,000 cars off the streets.

At LePrix, we are committed to doing our part to empower businesses to keep luxury in circulation and thereby, extending the life of every pre-owned luxury item that is sourced on LePrix.

* This is a visual representation of how much CO2 and water LePrix has saved.

2024 and Beyond

While many are predicting 2024 to be another year of uncertainty, the resale industry has always been well-positioned. When there is a contraction in spending from consumers, many shift their spending to pre-owned, which offers value and quality. Similarly to the off-price retail industry, consumers are still spending but looking for better deals and value. In addition, consumers still want luxury but now they will focus on purchasing items considered investment pieces as well as lower-priced luxury goods.

The next generation of GenZer’s power will only grow with increased demand for sustainable and purposeful purchases.

Image courtesy: @leprix

What the luxury houses do in the retail industry will impact the resale industry. With continued price increases, there will be a tipping point where the consumer will push back on the prices and this will reflect with a softening in demand in both the retail and resale industry. In the resale industry, typically what we see when brands increase prices and the demand continues to rise, demand for pre-owned also rises. However, as a tipping point is reached and consumers push back on price increases, the resale also sees an impact and prices will decline in tandem.

Brands such as Hermès will continue to grow in the pre-owned industry just as the retail industry, outshining other rival luxury brands. The effect of the strong demand and limited supply, will only show more growth for the investment styles like the Birkin and Kelly.

Brands such as Chanel and Louis Vuitton will continue to show strength in the resale industry in 2024. However, our team predicts the demand for which styles will continue to shift from more fashion and trendy to core classics like Chanel Classic Flap in Caviar and Louis Vuitton Neverfull MM.

Image courtesy: @leprix

Image courtesy: @leprix

As the luxury community delves into the realm of pre-owned bags, which specific luxury brands or styles are currently capturing your attention the most? Let us know your thoughts.

Read related articles:

Hermès Birkin & Kelly Prices 2023: How Much Have Prices Increased?

The Surprising Original Price of Favorite Chanel Items in Your Closet

Breaking News: Chanel Price Increases are Happening Now Internationally

Vintage Vault Vol. 1: Navigating the Highly Collectable World of Vintage Chanel

Vintage Vault Vol. 2: 5 Most Coveted Vintage Chanel Bags

Love, PurseBop

XO

Updated: December 16th, 2023

Comments