Benjamin Franklin’s old adage “empty pockets travel safer” seems particularly appropriate right now. Especially for owners of high value items. Faced with nearly daily news stories about thefts- from retail and resale stores, private homes, and individuals, what’s a luxury lover to do?

Of course, one option is to lock everything valuable in a bank vault never to be used. That might work for a purely speculative investor hoping the value appreciates. But most who purchase expensive handbags, jewelry, and watches want to use them. The question is how to do so safely. And, what does “safe” mean today?

Image Credit: @ec24m

The Latest Crime Sprees

A quick review of what’s been going on lately is in order. Bag-snatchings, pick-pockets, and home and business break-ins, are nothing new. Recently, however, the criminal activity has taken on a bigger and more brazen element, likely the work of gangs. Moreover, whereas jewelry used to be the primary target, now luxury handbags, both new and used, are the prey, not the contents. That, of course, makes sense since bag lovers often carry handbags worth many times more than what’s inside!

And while technology is advancing around the world (and theoretically protection) it is also facilitating some new crimes beyond identity theft. The latest involves a follow-home robbery where Hermès and Apple air tags are placed in/on cars and coat pockets allowing criminals to follow people home, stalk them, and demand their expensive items, whether at home or travelling.

For example, Sports Illustrated swimsuit model Brooks Nader says someone placed an AirTag into her coat pocket when she was out with friends in New York City. She received a notification on her iPhone that she was carrying an “unknown accessory” and that “[t]his item has been moving with you for a while. The owner can see its location.” She believes the device was in her pocket for 5 hours before she received the first alert.

So, as always, go with caution, be aware of surroundings, and make risk assessments. And always remember that life is more important than “stuff” no matter how expensive. In other words, when threatened, hand over the Birkin (even if it is your holy grail bag).

However, due to the technology, sophistication, and boldness of the crimes committed lately, it is time to consider (if you haven’t already) adding a measure of protection for prized possessions. The options essentially boil down to this: strategies to prevent loss and/or insurance to recoup value in the event of loss. Both methods have practicalities and pitfalls.

Loss Prevention with Vaults and Safes

“Lock it up” is one way to prevent losing those valuables. As mentioned above, you can store them in a safety deposit box at a financial institution. This is almost airtight but clearly inconvenient if or when you want to use and enjoy your possessions.

Alternatively, or in addition, you could lock it up at home. A home safe, possibly with fingerprint entry, or a securely locked closet may be a viable option. However, it’s not iron-clad, even if the safe supposedly is. In other words, safes sometimes get cracked.

Moreover, with the recent surge in home invasion robberies, and the air tag tracking devices used to follow people home from upscale restaurants and shopping districts, a safe could be seen as the target. After all, its very existence says “here’s all my valuable stuff.” Not surprisingly, there are reports of burglars holding homeowners at gunpoint demanding they empty their home safe of all valuables, collectibles, handbags, and cash.

An extension of this is to have two hidden safes in your home. If you are forced to open one safe, the burglars may not suspect you have a second one containing valuables. However, this is risky as trying to outsmart an armed thief could get you hurt. Plus you have to remember what you put in which safe!

Home closet @m.t.l1968

Insurance

Whether you go the “lock it up” route or not, the next consideration is insurance – a way to recoup monetary losses. To be clear though – you don’t get back your beloved items and you may not receive your perceived value. Nevertheless, if you opt for insurance, it is crucial to obtain the correct type of insurance and the appropriate amount of coverage. Moreover, as you’ll see, when it comes to choosing policies, buyer beware and be sure to read the fine print.

Homeowner Policies

The most common policy is homeowners or renters insurance. But, do you know whether it will cover the value of your luxury possessions in the event of theft, loss, or damage? The truth is most likely it will not.

In fact, a homeowners insurance policy may not be the best way to cover expensive fine jewelry, watches and luxury handbags. These policies are too broad and intend to cover the entire contents of your home, not individual luxury items or collectibles. Disputes could arise with your insurance company over whether specific items are covered (or not) and their value.

@fortunaauction

Some homeowner insurance policies do include coverage for “personal property,” but it is not always clear exactly what that means. Further, these general policies are often limited with respect to luxury items and valuable collectibles.

Most insurance companies consider items that are expensive, rare, or collectible to be “valuable” personal property. Typically these are not covered under the “personal property” limits in your standard homeowners policy. What that means is that fine jewelry, watches, handbags, art, furs, and collectibles, likely are excluded from coverage.

It is important to read the policy carefully and/or speak with your insurance broker to understand whether any of your luxury possessions are covered and under what circumstances. For example, does coverage include theft, loss, and damage, or just some of those events. Beware that the total amount of coverage for valuables under a standard policy is usually $1500 per item.

Obviously, this is substantially less than the amount actually paid for the valuables at issue. Some items (such as luxury handbags) may not be covered at all due to certain exclusions or limitations listed in the policy.

Paris, France 2019 @pursebop

Additional Policies

Another approach is additional coverage for your luxury items. There are two options: an add-on floater to your existing homeowners policy or a completely separate policy.

Add-on Floaters

An add-on floater (or rider) to your existing homeowner’s policy provides additional coverage for specific items which are listed in detail. It is called a “floater” because it covers easily movable property. Items such as fine jewelry and watches may require an appraisal and possibly also receipts showing the original cost of the item. It is very important to list every item you intend to be covered or a dispute may arise if you claim a loss.

Now for the downside. Naturally, the add-on floater comes with a cost – an additional charge. It also is usually subject to a deductible and may not cover your luxury handbags. Be sure to discuss this issue with your insurance broker. Many insurance brokers advise that it is best to have a separate stand alone policy (discussed below) to protect all your valuable items.

Image Credit: @elb4z

Separate stand alone policy

When it comes to insurance, likely the best option for your luxury handbags, fine jewelry, watches, and other collectibles is a stand alone policy sometimes called a Personal Articles Policy. This policy provides extra coverage for your specific (or “scheduled”) valuable items that may be stolen, damaged, or lost.

There are several benefits to this policy. First, coverage is provided whether the loss occurs inside or outside your home or even your community. This policy “travels” with your valuables. Second, there is typically no deductible on this policy. Third, if you file a claim on this policy it will not be charged against your homeowners policy. A claim filed on your homeowners policy, however, usually results in an increased premium charge. Fourth, this policy should cover theft, loss, and damage to your item. If your Birkin or Kelly is damaged due to fire, flood or other event, make sure this policy will cover the cost of repair by a professional such as the Hermès spa.

Remember the woman whose Hermès Birkin was damaged at a New Jersey Country Club restaurant? If she had a Personal Articles Policy with replacement value coverage, and her pink Birkin was listed, the repair, or replacement, likely would be covered.

Read Also:

So far so good, right? But here’s the kicker. Who decides what is the replacement value? And how is it determined? Let’s examine this dilemma closely.

Replacement Value of Luxury Handbags

Determining the replacement value of your Hermès or Chanel handbag is not so easy. As every handbag collector knows, just getting any quota bag from Hermès, or in demand Chanel classic flap, is extremely difficult. If you have to replace one or more of your coveted bags, it is practically impossible. Unless, of course, you venture to the resale market. It is possible to replace your holy grail bags but it will cost more than what you paid at the boutique.

A review of the secondary market shows new pre-owned Birkins and Kellys selling on the resale market for two to three times the original cost, particularly the smaller sizes (B30, B25, K28, K20). Should your luxury handbags be stolen, replacing all of them at the original boutique is both unlikely and unrealistic.

Making it more difficult is that most insurance companies are not familiar with luxury handbags. They are familiar with antiques, fine art, and heirloom jewelry but not handbags. Frankly it is difficult for a non-luxury handbag owner to understand that although your Rose Sakura mini Kelly II cost $8,000 new at the Hermès boutique, not only is it unavailable in the store but replacing it is nearly impossible. On the resale market it would now cost more than $30,000. If your mini Kelly was a special order it could require over $40,000 to replace.

Clearly it is essential that under any itemized personal property coverage or a Personal Articles Policy list each handbag and include an appraisal of its present market value.

@mrs_bcworld

Also, any add-on or stand alone policy you purchase must include the replacement cost, not just the actual cost, of the handbags stolen, damaged, or lost. Replacement cost is the amount of money it would take to replace your damaged or stolen handbag in today’s market. Those two numbers likely are quite different.

Furthermore, not all items are equally easily replaceable. Compare for example an Hermès quota bag to a large diamond. Generally, another stone with the same certified specs can be found, or at least valued. Of course, the difficulty increases depending upon how rare the stone is, as for example a large (e.g. 6 carat), D color, flawless diamond. However, if insured for its replacement value based on a recent professional appraisal, you end up with a comparable stone (which can be disputed) or cash.

Image Credit: @wongerisme

On the other hand, replacing a Himalayan Birkin 30 from an Hermès boutique is virtually impossible. To replace it on the resale market could cost $200,000-300,000. Arguably, every Hermès quota bag is extremely rare and impossible to purchase from the boutique.

For this reason, add-on floater or separate personal property policies should include the original purchase receipt, photographs of the handbag, a professional appraisal of the handbag, and a current listing from a reputable online reseller of a similar handbag showing the present day cost to purchase that handbag.

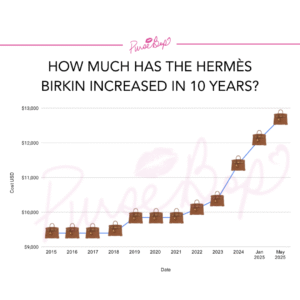

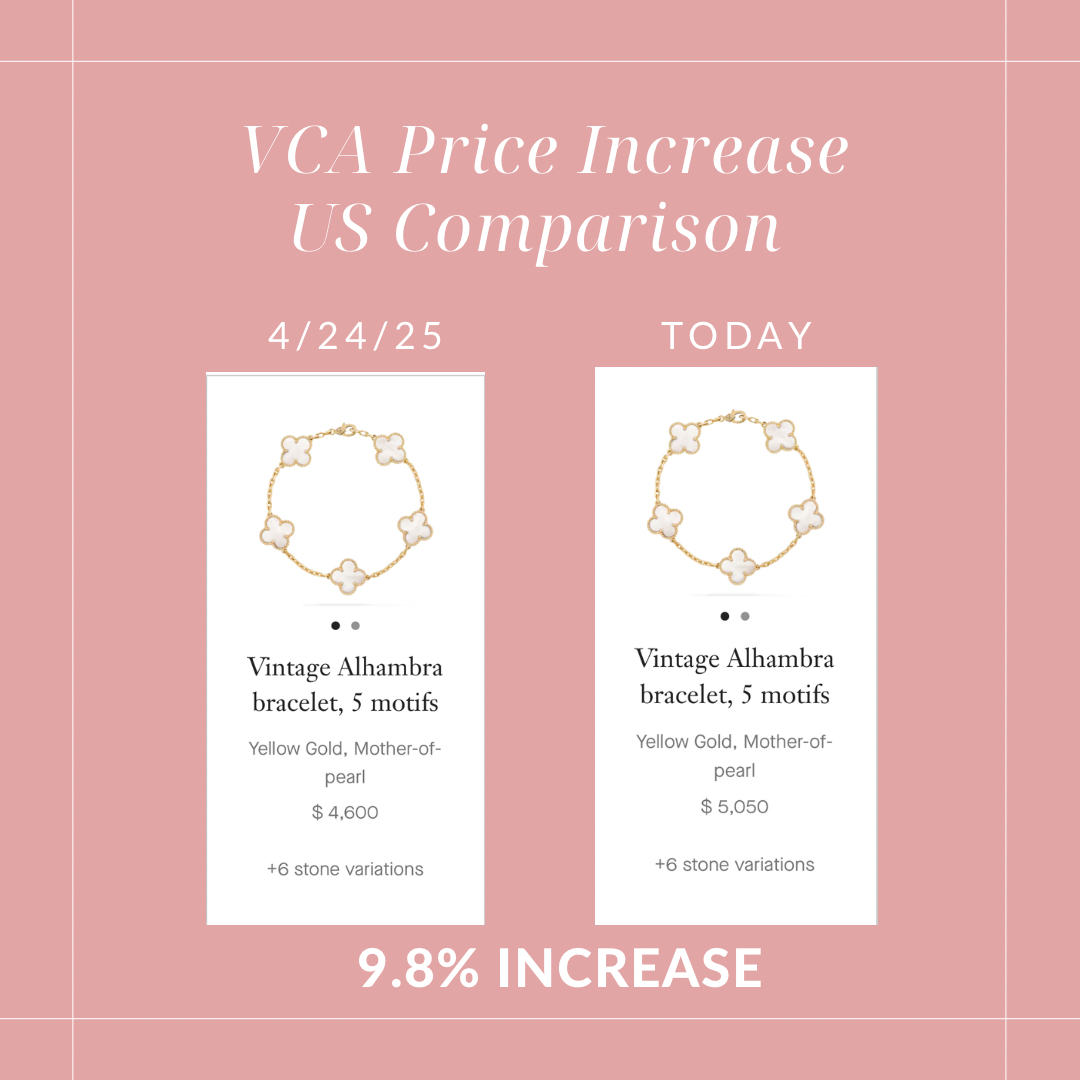

It is important to update the appraisal and reseller listings of your luxury handbags regularly as values tend to change over time. The prices on the resale market have skyrocketed. With every Hermès, Chanel, Van Cleef, or Rolex price increase, the resale market price goes up as well. The more detail you provide, the more likely you will be able to recoup the present day value or replacement cost of your beloved collectibles.

Share your opinions about insuring and protecting your luxury possessions in our poll below and we will post the results in a follow-up article.

POLL

Love, PurseBop

XO

Updated: January 22nd, 2022

Comments

1 Responses to “Guide on How to Protect and Insure Your Handbags + Reader’s Poll”

Which separate policy insurance company is recommended for Hermes and Chanel handbags?