Another installment of the PurseBop In Paris series… If you need to catch up first, read these articles:

Part I: Hermès in Paris With PurseBop: Part I of the Trilogy

Part II: PurseBop Scores at Hermès Faubourg Saint Honoré: Part II of the Trilogy

Part III: A Tale of Two More Hermès Kellys

Part IV: How Much Does a Birkin Cost in Paris? – The Handbag Math

PurseBop Falls for a Chanel Boy in Paris

Part V: How Do You Bring Home the Hermès Kelly… and Everything Else After Shopping in Europe?

PurseBop Falls for a Chanel Boy in Paris

Goyard Tote Battle: Artois Takes on Saint Louis

VAT Refund lines at Charles de Gaulle airport.

The PurseBop in Paris series concludes with advice on VAT, customs and duties when leaving the EU and returning to the United States. If you’ve followed PurseBop’s adventures, you’ve eaten, toured, shopped, purchased and packed everything for home. Now it’s time to deal with the “authorities” when bringing it all back.

Our number one tip – be honest. Don’t hide your purchase or lie about the costs. If and when you’re caught, the potential penalties just aren’t worth it. We also now know there is some connection between VAT refund applications and global entry. It certainly would make sense – with all tied to your U.S. passport. We have heard several reported cases of Global Entry being revoked for failure to fully disclose purchases. As a cautionary reminder, we suggest you read and re-read PurseBop community member Dream’s re-entry experience and the exhaustive review of her luggage and purchases, and she was declaring her purchases.

Read:

VAT, Duty and Customs Warning – Declare Your Purchases

Tips for Travel and Customs While Shopping Abroad: Gucci Case Study With Detailed Handbag Math

Luxury items purchased in Paris.

Moreover, to the extent you leave home with your own luxury goods, travel with some form of documentation that those items predated your trip. Carry receipts or dated photos on your phone… just so you can verify they were not recent overseas purchases. This is particularly relevant to your travel carry-on handbags, especially if you are taking along expensive ones, and of course your jewelry. You may need to prove the Birkin or the VCA necklace you are wearing isn’t a new purchase.

A photo with your luxury items and boarding pass always serves as a good reference should there be any issues with customs upon returning into your home country.

VAT Refunds

If you’re new to shopping while traveling (or travelling for shopping), you need an education on VAT and VAT refunds. Otherwise, consider this your refresher course.

What is VAT?

VAT is the “Value Added Tax” built into prices in the EU. Think of it like a sales tax, except it is included in the price of goods and services rather than being calculated at checkout. Each country sets its own VAT which varies depending upon the type of goods. In France, VAT ranges from 5-20%.

Who Gets a Refund?

Visitors and those who do not permanently reside in an EU country may be able to shop VAT-free at certain stores. You still pay the VAT at the time of purchase, but you apply for a refund. Naturally, there are administrative fees associated with process this so you won’t get back all of the tax, but you will receive a substantial percentage. Interestingly, not every brand provides the same percent refund. In our travels, the Hermes VAT refund is 10% while Chanel and Goyard gave 12%.

How to Get a VAT Refund?

There are two main methods of getting your VAT refund.

- Use the Store’s Refund Affiliate: VAT-free shopping stores often post signs indicating tax free shopping (like duty-free shops in the United States). At checkout, the shop will give you a tax free shopping cheque to present at customs when leaving the EU. Customs will stamp your cheque and you can get the refund either immediately at an airport service desk or kiosk (if you have time and the wait isn’t too long) or mail it to the refund service.

- Get a Refund Directly from the Shop: Some stores handle VAT refunds themselves. Once you have the form stamped by Customs you mail it back to the store and it will either send a check or refund your credit card.

For more information, read: How It Works – VAT Refund and Custom Duties

Hermès, Paris.

Troubleshooting the VAT Refund Process

As is the case with much in life, things don’t always go smoothly when seeking your VAT refund. If possible, allow extra time at the airport to deal with paperwork mixups, long lines and the like. This is one of those instances where you do need to cross your t’s and dot your i’s. Here’s what we did on this last trip to Paris:

For starters, when making our purchases, we asked each shop for the VAT refund paperwork. Make sure that the credit card used for paying matches the passport used for your travel.

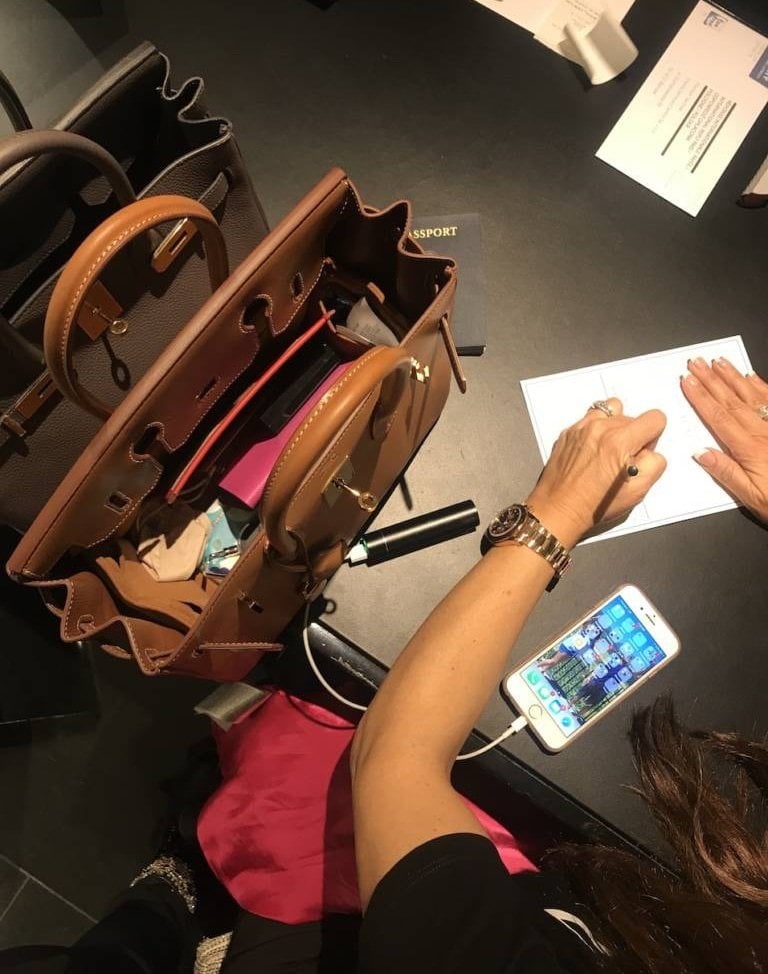

Sitting with Chanel personnel preparing VAT forms at Avenue Montaigne.

The evening before we were to fly home, we organized all of our receipts with the proper mailing envelope. As you know, we also packed our bags so that our purchases were in carry-on luggage, readily available for VAT (leaving the EU) and customs officials (arriving in US) inspections (as well as safe and secure).

Read: Part V: How Do You Bring Home the Hermès Kelly… and Everything Else After Shopping in Europe?

If carry-on isn’t an option, at least try to consolidate your purchases into one suitcase to make everything easier to access. Officials are authorized to check each item and corresponding paperwork.

As said above, leave plenty of time to handle VAT refund process at the airport. We were able to use the refund kiosk, but if you purchased many items, it may take time and you still could be referred to an agent. At the kiosk, we had to scan each receipt individually and wait for a green light. That green light indicates approval and the receipt can then be put into the mailing envelope and dropped into a VAT refund box. However, if you don’t get a green light, you then need to see the VAT officer. There likely will be a line to do this.

Even after finishing the process, your paperwork isn’t quite done. Save your VAT refund receipt… you’re going to need it to follow up on the status of the refund if it doesn’t come through.

Additional lines to see the officer- if at the kiosk, your items did not scan and result in a green light. These receipts need to be shown to the customs officer for him to approve before they can be mailed.

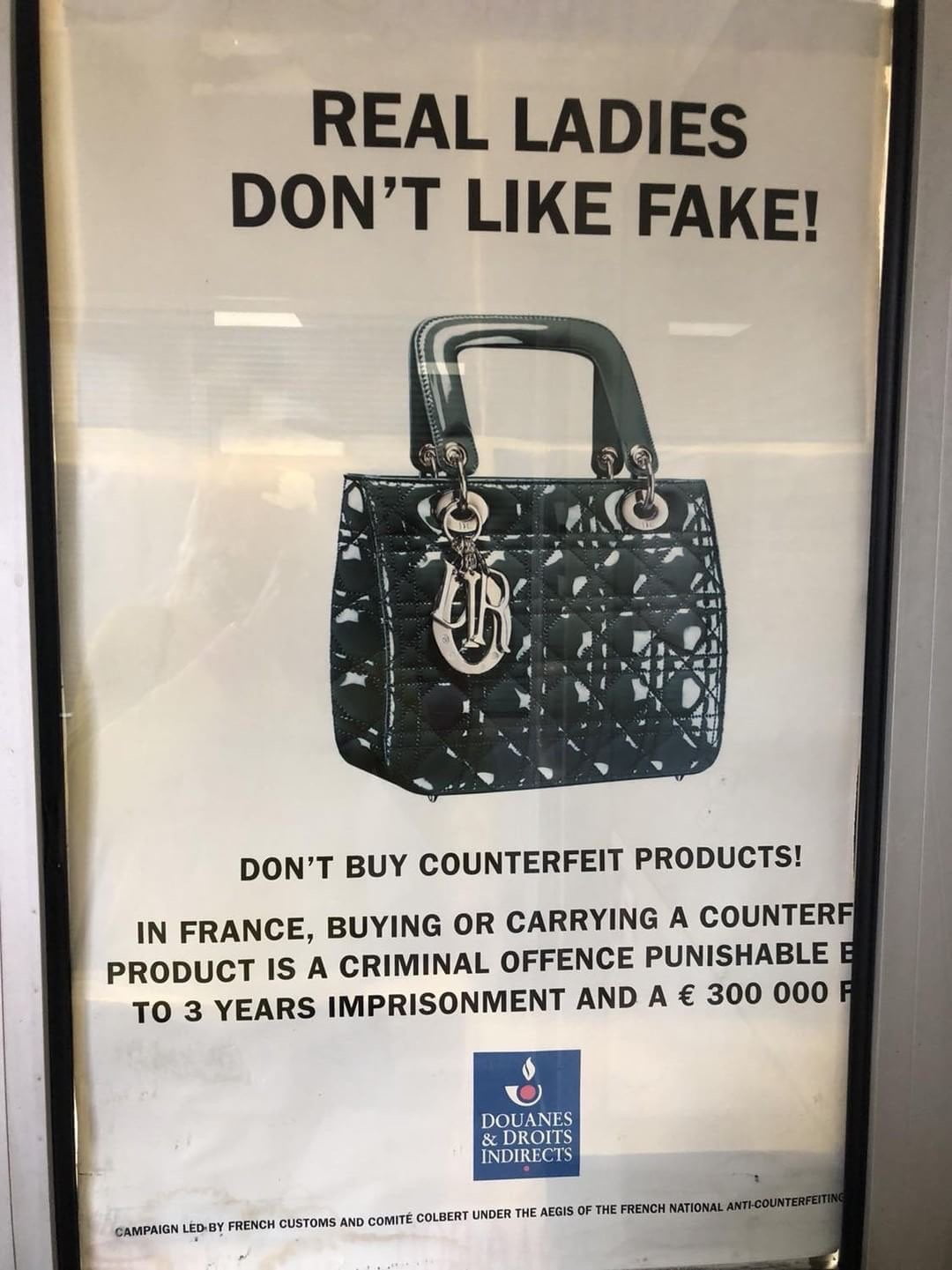

We’d be remiss without giving you this final reminder for leaving France: don’t take fakes or counterfeit goods. As we’ve written before, there are signs all over Paris airports about the penalties for these goods. Paris airport officials confirmed for us that these items are not permitted and may be confiscated.

Customs, Declaration and Paperwork

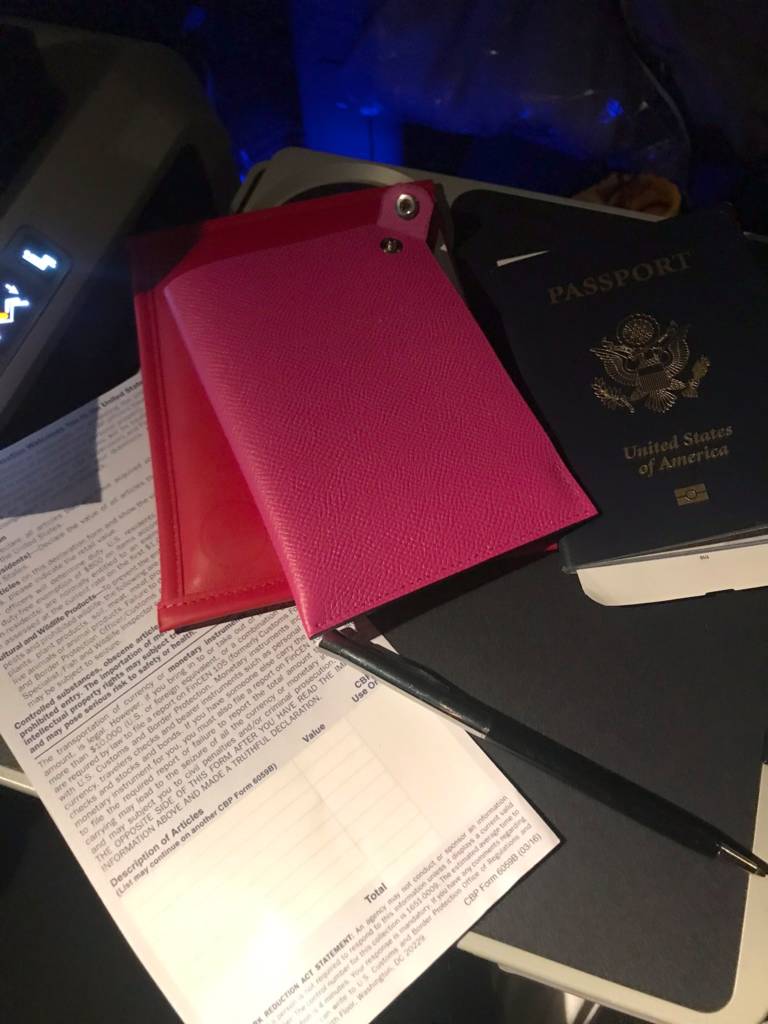

Aboard the airplane, you will be given a Customs form to fill out and hand in. This form requires assorted declarations – that you’re not bringing livestock or food etc. It also demands a listing of purchases abroad along with value or cost. In this instance, even though the (in our case) French price included VAT, since we applied for VAT refund, you may deduct the VAT amount when listing the value of goods purchased.

Again, and we cannot stress this enough, please be honest and transparent about your purchases.

Inflight form you need to fill out if declaring goods.

Each person is permitted to bring in $800 worth of goods duty-free. Our understanding is that these purchases may be aggregated for a family traveling together using one declaration form, notwithstanding Dream’s experience.

Another way of saying this is that your purchases over $800 are subject to U.S. duty. Obviously, PurseBop’s Rose Lipstick Tadelakt Kelly, Chanel Boy and Goyard Artois well exceeded $800 value. We are not experts on the duty levels but can tell you that different goods are subject to different amounts. Even handbags vary between materials such as plastic, leather or exotic. Officers seem to be inclined to be modest on their calculations as a reward for transparency. This has been our personal experience.

You can pay your duty charges with your credit card. No need to worry about having cash for this.

Nesting bags for carry -on luggage. It’s important to keep your new purchases handy for quick access in the event you are requested to present them to an officer either for VAT in departure city or at customs when meeting an officer to declare.

VAT versus Duty and Handbag Math

One thing sadly becomes very clear about VAT and duty when you calculate potential savings from shopping abroad: a VAT refund provides little to no savings as it is virtually cancelled out by U.S. customs duties. Finding a bargain abroad right now is limited to goods that actually have lower prices abroad (or instances where currency variations provide an advantage). Read: How Much Does a Birkin Cost in Paris? – The Handbag Math

Read Related Articles:

Hermès in Paris With PurseBop: Part I of the Trilogy

PurseBop Falls for a Chanel Boy in Paris

Travel Alerts If You Are Headed to Europe This Spring

New Development In the System To Buy A Birkin

How Much is Your Handbag Collection Worth?

Buying a Birkin in Paris is Still Not Easy

Love PurseBop

XO

Updated: June 24th, 2018

Comments

1 Responses to “Part VI: The VAT and Customs Procedures”

I’m planning to buy gift for my husband and 3 children from Louis Vuitton. That s more than $800.00 worth. What do I do or how much they will charge me for custom declaration for the difference from $800.00?